CATALYZING FINANCIAL SERVICES IN INDIA

The Catalyst Incubator ‘Fintech for the Last Mile’ promotes innovative and scalable fintech solutions that address the needs of traditionally underserved market segments.

Building for the Last Mile

While the infrastructure to build inclusive financial services has recently been upgraded with the roll-out of UPI, Aadhaar, and India Stack, we are yet to see the power of these systems delivered to end users at scale. There also remains massive scope to build deeper and more targeted workflows on top of an increasingly commoditized payment transaction layer. These software, hardware, or in certain cases, operational solutions can generate tangible and immediate value to key stakeholders across commercial use cases – be it through analytics, access to financing, or streamlined business processes. Catalyst, as part of its broader mission to help small business ecosystems access the benefits of digital finance, will co-design, analyze & validate, as well as enable the scaling of successful solutions. Towards this end, Catalyst offers innovative entrepreneurs technical and financial assistance in the form of performance-based financing, ground operational resources, research methodologies, broader ecosystem linkages, and domain expertise.

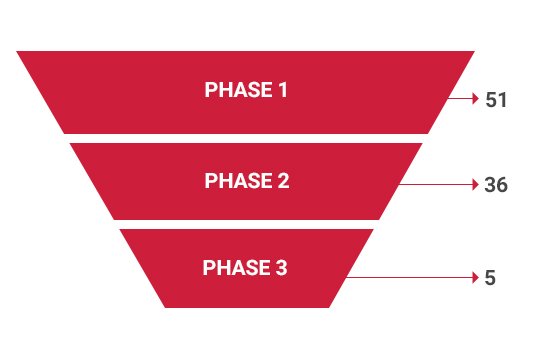

The first round of selection of the incubatees took place in February 2018 where five applicants were selected.

We attracted 51 qualified leads through privileged channels like VCs, impact investors, incubators, universities, mentors, and social media

Pipeline: Applicants across 13 sectors and 14 cities

- Top Sectors: Credit (~39%), Payments (~18%), Invoice Management (~12%)

- Locations: 14 cities including Jaipur, Kanpur, Aligarh, and Bhubaneswar

- Startup vintage ranged between 1 month to 15 years..

- One fifth of applicants had a female(co-)founder

THE FIVE SHORTLISTED START-UPS

Fingpay is a payment and collection solution that enables merchants to accept digital payments from customers who do not have either a card, wallet, or a mobile.

Paynearby enables existing corner shops to become a digital financial services hubs, thereby creating the world’s largest hyperlocal fintech network.

Merapaper provides a micro-ERP to digitize the customer lifecycle, billing, and payments for small B2C merchants.

Paybee’s solution automates and digitizes B2B collections in the distributor-retailer value chain.

Kaleidofin is a fintech platform that propels the un/under-banked towards meeting their real life goals by providing tailored financial solutions at scale.

THE PROCESS

Up to 33 lakhs*

per award for activities lasting up to six months and additional benefits

Opportunity to refine your product or service

and test hypotheses over six months in a dynamic market environment

Mentorship from thought leaders

in digital finance companies, social enterprise, and technology entrepreneurship

Access to small businesses,

customers, and suppliers in Jaipur to test your product or service, run pilots, and validate hypotheses

Access to Catalyst’s research team

and on-ground learning infrastructure

Access to Catalyst’s broader partner ecosystem,

including other fintech companies, traditional financial institutions and government & policy stakeholders

*inclusive of all taxes

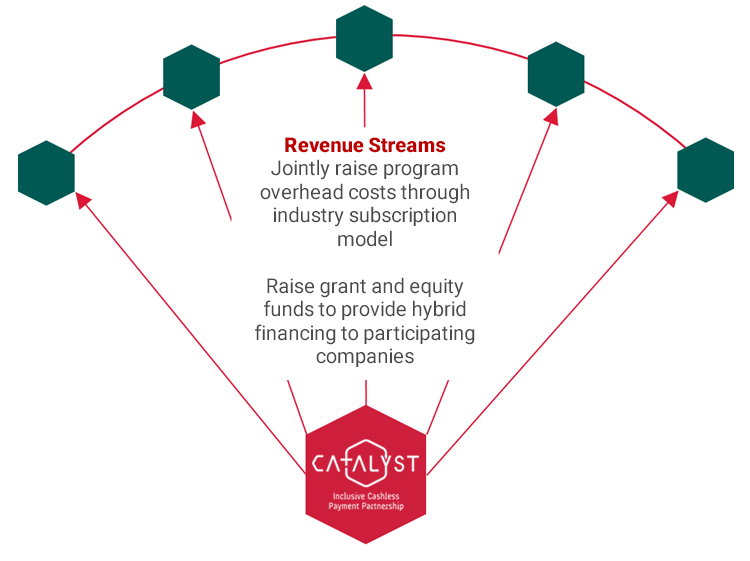

PARTNERS