PILOT PROJECT

ASSISTED E-COMMERCE THROUGH

“DIGITAL KIRANA”

The pilot project conducted by the Janalakshmi and Snapdeal teams generated extremely rich consumer insights which helped to cement learnings on ecommerce models for low income households

ABOUT THE PROJECT

Period: September 2015 – Mar 2016

Partners: Janalakshmi Financial Services (kirana store network) and Snapdeal (ecommerce service provider)

Objective: To use e-commerce as a hook to bring neighborhood ‘kirana’ stores in low-income communities onto a digital payment platform, to accelerate merchant acceptance and increase digital payment adoption amongst consumers in these communities.

Project Overview: Neighborhood store owners (Janalakshmi agents) serve as order, payment and delivery agents for Snapdeal’s e-commerce services. Agents pre-pay for the e-commerce purchases digitally through their ‘Jana Cash’ (mobile) wallet, digitizing what would otherwise have been a cash-on-delivery payment, strengthening the local digital payments ecosystem.

Through this pilot, Janalakshmi selected seven to eight agents from its network and on-boarded them as Snapdeal agents. These agents were each given a tablet, with which they could order products from the Snapdeal product catalogue and also carry out business as Janalakshmi agents (mobile recharges, DTH recharges through the Jana wallet). The agents helped consumers browse and order Snapdeal products. They collected cash from consumers and prepaid for the products on Snapdeal’s website through the Jana wallet. Snapdeal delivered the products to the agent and consumers collected the product from the agent.

At the end of a predetermined cycle, Snapdeal paid Janalakshmi a commission for the transactions conducted by the agents. The commission amount was a percentage of the sales values. Janalakshmi then passed the commissions to the agent.

PROBLEM STATEMENT

Only 6% of retail establishments in India currently accept electronic payments.

This lack of widespread merchant acceptance networks is a critical missing link in India’s digital financial inclusion journey. With a wider network of available merchants accepting digital payments, more users will become aware and potentially switch to digital payment options for various transactions.

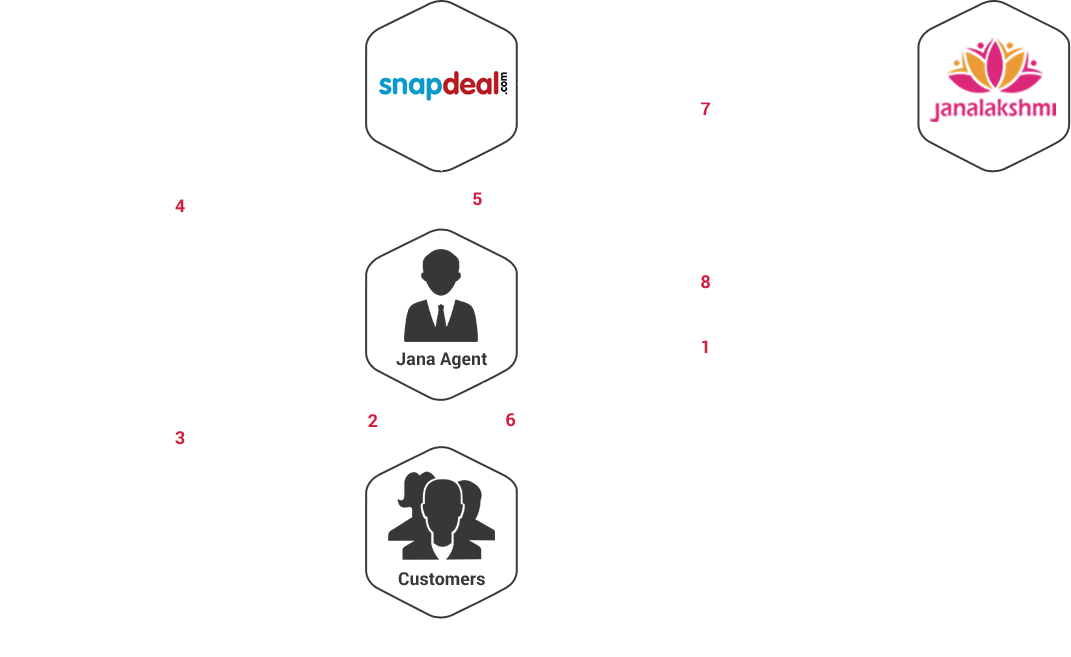

OVERVIEW OF

THE MODEL OF PLAYERS

KEY LEARNINGS

User Experience

Most agents did not find the opportunity cost of running the assisted e-commerce business very high.

This was especially true of merchants who ran mobile repair shops or clothing shops, since these businesses did not see a constant traffic of consumers throughout the day. Also, despite the time-consuming nature of the transaction which could take up to half an hour per customer, merchants were willing participants. A variance in performance of merchants was observed which may be attributed to the inherent selling skills and agility of merchants. One merchant was far more successful, because he was able to tap into demand among the low-income migrants in his community despite their lower digital literacy and smart phone use.

Making advance digital payments did not seem to be an area of concern for agents, especially as sales volumes were limited.

The agents did not find paying digitally for products to be an issue. They generally kept a minimum balance in their account for mobile top-ups and other bill payments. They could also top up their account easily by calling the distributor. This is remarkable in the Indian e-commerce space, where 60-80 percent of orders tend to be cash on delivery (CoD).

Even for first time ecommerce consumers, making advance payments for the product did not pose a significant challenge.

Consumers interviewed often knew and trusted the agent to complete the transaction on their behalf. In fact, in instances where the agent could not complete the transaction immediately (e.g., insufficient balance in the account, slow internet speed), consumers were comfortable leaving cash with the agent and trusting he would make the purchase at a later time.

Merchants were comfortable with the stages of the e-commerce process.

None had trouble with the ordering and payment process. The initial training imparted to them on using the tablet for placing orders and making payments was critical in adding to their comfort in carrying out the transaction.

Overall, while the pilot demonstrated potential to improve agents’ comfort with digital payments, it may be too soon to draw inferences about the ability of the model to drive broader digital payment adoption.

This is because e-commerce remained a small part of the agent’s overall revenue. Agents themselves seemed comfortable receiving cash from consumers as opposed to receiving payments digitally.

Model and Process

Access to data/ connectivity:

The assisted e-commerce model worked well in communities with limited smartphone access. The most successful agent in our sample was able to tap into a relatively lower-income migrant community (which had no access to smartphones) in his locality. However, this could also be due to agents’ selling prowess, for example, the most successful agents tended to be in “push businesses” such as gift or dress shops as opposed to the traditional grocery/kirana stores.

Price sensitivity:

Consumers were attracted to the assisted ecommerce concept, but preferred to reach out to someone in their community to compare the offering to Snapdeal’s online portal and other websites. Upon finding that the discounts were no greater than what was already available online, consumer’s interest in the channel weakened. This underscores the importance for retailers to create a differentiated offering such as a curated product portfolio.

Returns & cancellations:

Problems with returns and cancellations were a key pain-point and affected merchant and consumer experience and likely uptake. During the pilot, we found that many of these consumers were first-time ecommerce users. For lower-income consumers, delayed refunds and returns can be financially burdensome. Customers who faced issues with product functioning were not keen to repeat the ecommerce experience, highlighting the important role of a seamless first experience in retaining customers.